This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

Last week, the U.S. Federal Energy Regulatory Commission (FERC) issued a landmark order mandating competitive U.S. wholesale power markets design market participation mechanisms that fully consider the unique physical and operational characteristics of energy storage. The sweeping order aims to reduce barriers to competition between energy storage technologies such as lithium-ion batteries and conventional energy generation such as natural gas and coal power plants.

The FERC order is a big deal because until now storage has mostly been forced to pretend it is a power plant and bid into power markets using procedures designed for electricity generation. But of course energy storage and power plants are fundamentally different technologies in nearly every way.

The latest FERC order comes as a welcome acknowledgement that the best way for power markets to economically integrate energy storage is to fully reflect its operating characteristics and constraints in electricity pricing and grid operations. After reviewing the order in detail, I am convinced that it will significantly reduce barriers to integration of grid energy storage in the future and improve the value of storage to the rest of the grid system and to consumers.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

What the Order Mandates, and What It Means

From a high level, the order mandates that U.S. wholesale electricity markets must design participation models for energy storage that:

Enable energy storage to participate in energy, ancillary services, and capacity markets. In other words, the markets must enable energy storage to (1) buy and sell energy by the megawatt-hour to seamlessly compensate for energy price volatility from one hour to the next, (2) sell its ability to balance grid supply and demand over sub-hourly time intervals, and (3) sell its ability to help meet peak annual demand;

Fully integrate energy storage with economic dispatch by specifying bidding parameters that reflect its unique physical and operational characteristics. In other words, amend the rules and software the grid operator uses to schedule power plants to also schedule energy storage resources, so that their operation is co-optimized with the rest of the system and they can compete to set the market price of electricity as either a buyer or a seller;

Allow all storage resources with a power capacity greater than or equal to 100 kilowatts to fully participate in the market. In other words, even storage resources much smaller than a traditional power plant can participate in the market; and

Require all energy sold to a storage resource that will be resold to the market is priced at the locational marginal price. In other words, storage should face the same time- and location-varying market electricity price as power plants regardless of whether it is buying or selling. This is meant to protect against, say, a storage resource buying power at a fixed retail price for 10 cents a kilowatt-hour and then selling it to the market at 20 cents a kilowatt-hour in the same instant.

The last two points are really about ensuring fairness. Storage can be a lot smaller than traditional generation, so the 100-kilowatts minimum size rule is needed to prevent undue barriers. And unlike traditional generation, storage can buy and then resell electricity, so special rules are needed to prevent storage from manipulating the market.

The meat of the order is in the first two bullet points. The following sections will dig into these two points in more detail.

What Are Energy, Ancillary Services, and Capacity Anyways?

There are essentially three fundamental products sold in wholesale power markets: energy, ancillary services, and capacity.

Energy is the bulk megawatt-hours of electric energy produced by electricity generation and sold to end use customers. This product is the most significant one in that it drives approximately 80 percent of retail electricity costs, establishes the location- and time-varying wholesale energy price (in dollars per megawatt-hour) that makes up most of a power plant’s revenue, and is really the main product for which power markets and the electric grid exist in the first place. The grid operator collects offers to sell energy from all of the generators on the system, selects the generators that can produce energy at the least cost, and then dispatches them to precise levels over 5-minute or hourly intervals. In doing so, the grid operator settles the market and establishes the market electricity price.

But the energy market alone isn’t enough. The physics of electricity require near real-time electrical balancing — i.e. far more frequent than the 5 minutes or so over which energy is dispatched. To accomplish this, the grid operator buys ancillary services, or flexibility services to make sure that electricity supply and demand are perfectly balanced at all times, from generators and other resources. Ancillary services include “frequency regulation service,” which is power plants ramping up and down in response to 4-second signals from the grid operator to balance supply and demand, and various classes of reserves, which is basically power plants standing at the ready in case there is an unexpected shortfall in generation.

Capacity is power production capability in megawatts procured by the grid operator to ensure there is sufficient resources available to meet peak annual demand. It is priced in dollars per megawatt, and typically procured years in advance so that there is sufficient time to plan and build any new power plants that might be needed to meet the anticipated level of peak annual demand. This is really nice for a power plant because it means they literally get paid just for existing. The catch is that some markets don’t evenprocure or put a price on capacity. Instead, they allow the energy price to spike high enough to incentivize new investments in power plants based solely on the speculation that the plant will be able to capture enough of those high prices to be worth it. (The best example of this is Texas’ Electric Reliability Council of Texas (ERCOT) market).

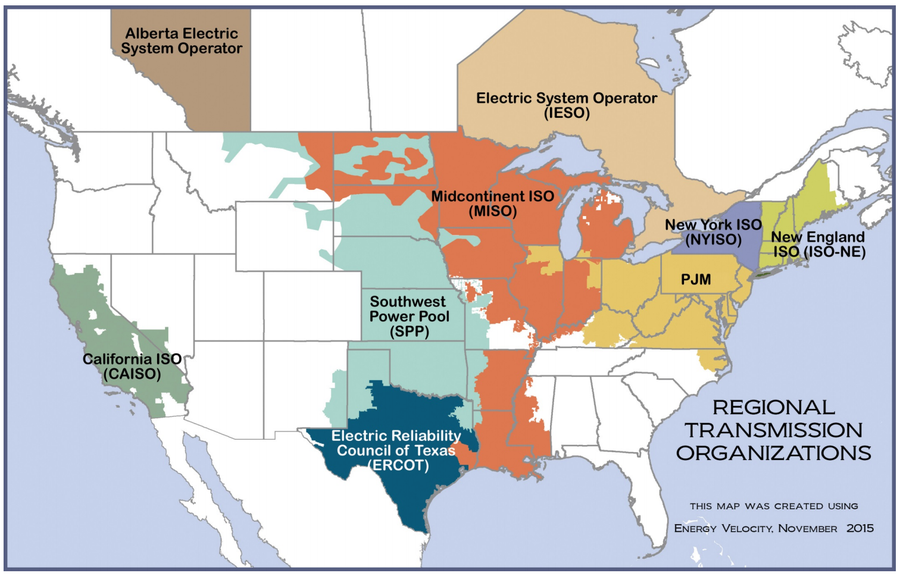

The United States has seven regional transmission organization (also called independent system operator) competitive wholesale power markets. Together they comprise the majority of power generated and sold in the United States. Source: FERC

Which of These Products Does Storage Provide Today? What Barriers Does the Order Aim to Break Down?

Today, storage is really only a major player in the ancillary services market, and specifically the market for frequency regulation, or balancing of electricity supply and demand over sub-hourly time periods. There are less barriers to storage participating in this market because it can switch between discharging and charging to keep the grid balanced without needing more than an hour or so of storage capacity and still compete with power plants. It makes sense really — storage is good at serving as a quick buffer between supply and demand.

Storage is significantly more limited in capacity markets and essentially does not play in energy markets because these markets are designed for resources that can provide energy for hours or days at a time without interruption, i.e. power plants. With the exception of acute reliability events, power plants never run out of gas, coal, uranium, or whatever else they are using to make electric energy. But storage technologies such as lithium-ion batteries face an extremely high cost premium with adding enough battery packs to store enough power to last more than a couple of hours.

Storage simply can’t fully compete in a market that requires a guarantee for the amount of energy that will be available for the next 24 hours or the amount of firm power capacity that will be available on the peakiest hour of the peakiest day of the year. What if that peaky hour becomes a peaky four hours? That would be a problem for a one-hour battery trying to provide peak capacity.

FERC’s order recognizes that even though storage might not be able to fully compete in a market that expects offers for energy sales 24 hours ahead of time and guarantees of capacity over unspecified durations years in advance, it can directly compete with generators in energy, ancillary services, and capacity markets if its unique physical and operational characteristics are taken into account.

A battery with one hour of storage capacity can’t efficiently bid into an energy market that expects 24 hours of continuous energy availability, but you bet it can beat out the expensive quick-start generator that comes on to meet an unexpected hour-long price spike.

Likewise, a battery with one hour of storage capacity can’t efficiently bid into a capacity market that expects full availability regardless of the duration of the peak, but the one hour of peak capacity it can provide is indeed worth something to the system.

So how does FERC intend to break down these barriers? By fully integrating storage’s unique operating characteristics into the software that is used to schedule resources on the power grid and establish the market price for energy, ancillary services, and capacity.

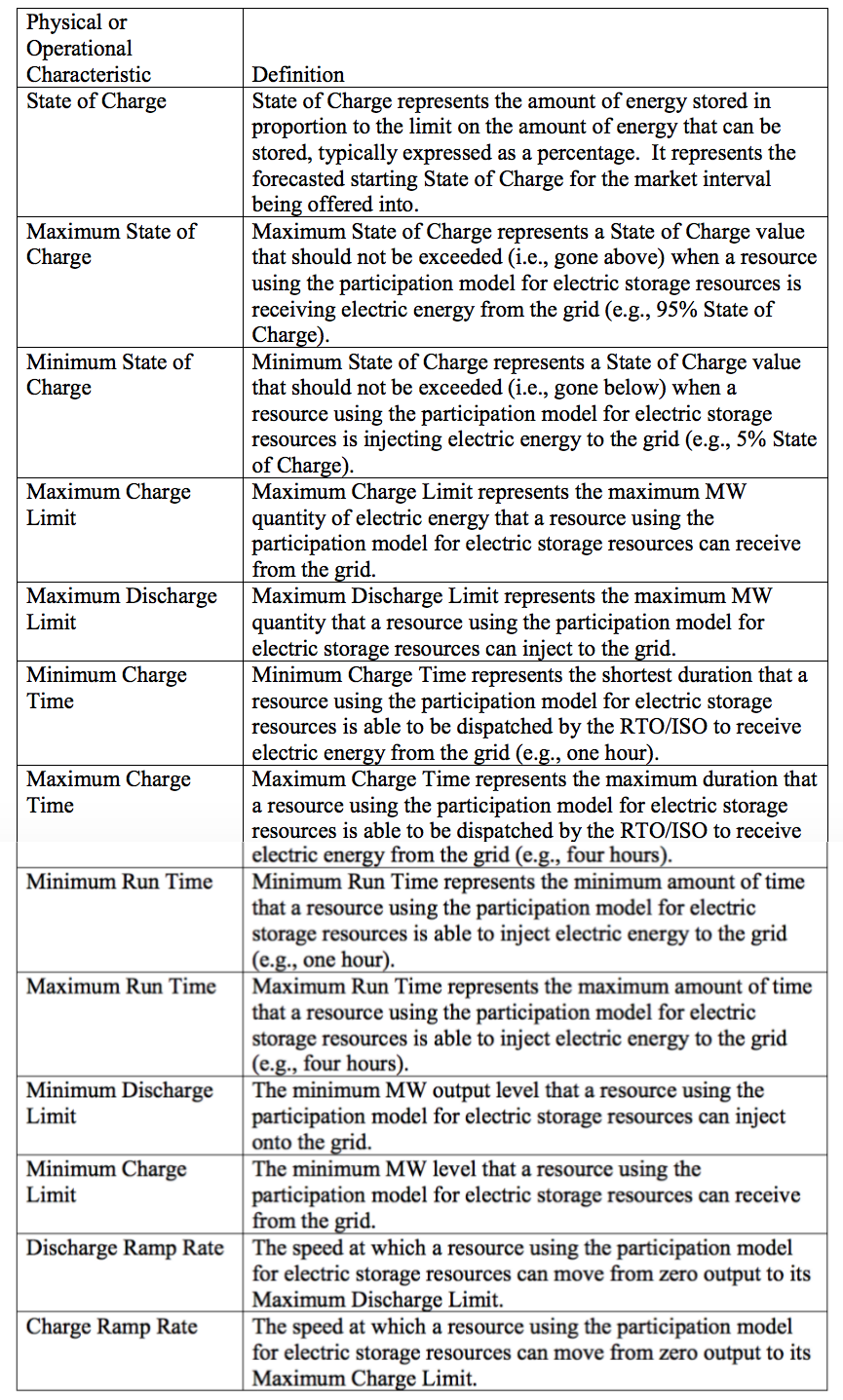

FERC Will Require Power Markets to Account for 13 Unique Energy Storage Physical and Operational Characteristics

The real limit of the software currently used to operate electricity markets is that it does not represent the amount of energy stored in a battery or other storage technology, also known as the state of charge, and account for this in the dispatch schedule established for generators, storage, and other resources. Storage is forced to masquerade as a power plant and strategically bid into the market in a such a way that it will (hopefully) never run out of stored energy. This is far from an economically optimal way to schedule storage in an electricity market — the market should have visibility into the amount of energy available from an energy storage system, and schedule its participation accordingly.

FERC recognized this fundamental shortcoming and then some. It specified a full 13 energy storage operational and physical characteristics that should be reflected in the parameters a storage plant submits to the electricity market along with its bids to buy energy (i.e. its maximum charging price) and its offers to sell energy (i.e. its minimum discharging price). The table below summarizes the 13 parameters that FERC will require wholesale markets to consider in energy storage dispatch. State of charge is at the top of the list.

Source: FERC Order No. 841.

Requiring power markets to accurately represent the operational capabilities of energy storage devices available to the system using the parameters given above will allow storage to be fully integrated into the economic dispatch process used to schedule grid resources and set the time-varying market electricity price. In theory, a storage plant will simply be able to submit a price at which it is willing to buy power and a price at which it is willing to sell power, and the grid operator’s dispatch software will do the rest.

What Does the Future Hold?

While I’m convinced that FERC’s order is a watershed moment for grid energy storage, there are still a lot of unknowns and potential pitfalls related to the achieving the vision of seamless economic storage dispatch I alluded to in the previous paragraph. There are significant technical challenges associated with accurately representing and telemetering state of charge — an operating state that varies continuously during charging and discharging operation. For this reason, FERC will allow storage operators to manage the state of charge of their systems independently if they so choose.

Furthermore, while the FERC order promises to reduce the technical barriers to full energy storage participation in capacity and energy markets, there are still significant economic barriers to full competition between energy storage and power plants. Wholesale electric energy prices are at historic lows, so it’s hard to anticipate how much storage will grow in wholesale energy markets even if it can achieve dramatic price reductions.

That said, I’m still very excited to see what rules and procedures the independent system operators that run the wholesale power markets will come up with to comply with FERC’s storage order. They have 360 days after the order is published in the Federal Register to send their compliance filing to FERC, and then another year to fully implement revisions to their market rules and operations.