This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

Since early in Donald Trump’s campaign for the presidency, he has pledged to end the Obama administration’s purported “War on Coal” and bring coal jobs back to ailing Appalachian communities.

Experts quickly rose to argue that the main driver of coal power plant retirements has been the plunging price of natural gas driven by the fracking boom, and not environmental regulations or renewable energy subsidies. The report commissioned by Trump’s own Department of Energy agreed, finding “the biggest contributor to coal and nuclear plant retirements has been the advantaged economics of natural gas-fired generation,” followed by low growth in electricity demand. Given these findings, experts rightly contended that even if Trump could wipe out environmental regulations, coal could not overcome the stiff competition posed by cheap natural gas.

That all changed about a month ago when Energy Secretary Rick Perry proposed a radical new Federal Energy Regulatory Commission (FERC) rule to prop up ailing coal and nuclear plants.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

Secretary Perry took advantage of a rarely-used provision of the Department of Energy Organization Act to propose his own rule to FERC, which regulates interstate electricity markets. Ordinarily, only FERC commissioners can issue a notice of proposed rulemaking, or NOPR in FERC-speak.

Perry’s NOPR argues that electricity markets do not adequately compensate the resiliency benefits of power plants that store large quantities of fuel on site — typically coal and nuclear plants — so these power plants should be protected from the threats of market competition and guaranteed full cost recovery and a fair rate of return. Here is the relevant text (emphasis added):

The rule allows for full recovery of costs of certain eligible units physically located within Commission-approved organized markets. Eligible units must also be able to provide essential energy and ancillary reliability services and have a 90-day fuel supply on site in the event of supply disruptions . . . The rule requires the organized markets to establish just and reasonable rate tariffs for the full recovery of costs and a fair rate of return.

Perry has proposed that FERC step into competitive electricity markets, which exist in much of the continental United States, and fully exempt any generator with a 90-day fuel supply from market competition. To use the common Conservative talking point, the rule literally picks winners and losers. And it does so using an arbitrary 90-day criteria with no supporting analysis (and that no rigorous analysis would support).

An Expensive Solution in Search of a Problem

Since Perry issued his NOPR, a wide array of groups has stepped up to oppose the rule, including renewable energy and natural gas trade groups, wholesale electricity market operators, former FERC regulators, attorneys general from ten states, and others.

The main argument against the rule is that it will fundamentally disrupt electricity markets but does not actually ameliorate the problem it cites as justification: grid resiliency and reliability.

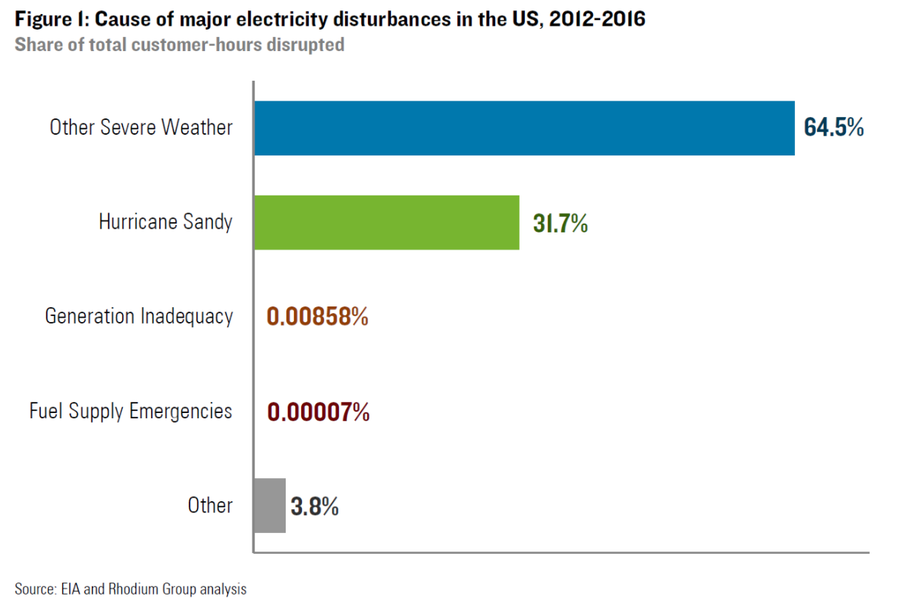

It’s well known in power systems circles that the main cause of power outages is damage and faults in power lines that pipe electricity from generators to buildings, and not the generators themselves. The Rhodium Group analyzed data reported to the U.S. Department of Energy by electric utilities to show exactly what proportion of outage hours are caused by storm damage to transmission and distribution lines versus generation shortages or fuel supply emergencies. They found that just 0.00007% of customer-hours disrupted, or the duration of outages multiplied by the number of customers they affected, were caused by fuel supply emergencies — the only aspect of reliability addressed in Perry’s NOPR.

Analysis of electricity outage data by the Rhodium Group found that just 0.00007% of customer-hours disrupted, or the duration of outages multiplied by the number of customers they affected, were caused by fuel supply emergencies. The vast majority of customer-hours disrupted were caused by severe weather. Source: Rhodium Group

These data do not include the most recent U.S. outages caused by Hurricanes Irma, Harvey, and Maria, all of which were largely driven by damage to power lines. Furthermore, it seems the generators most affected by Hurricane Harvey were actually coal power plants — which are assumed resilient to fuel disruptions by Perry’s NOPR. Here is an account of what happened at Texas’ W.A. Parish coal plant from its owner, NRG Energy:

The external coal pile at W.A. Parish became so saturated with rainwater that coal was unable to be delivered into the silos from the conveyer system. In response to that situation, we transferred W.A. Parish Unit 5 and Unit 6 to natural gas rather than coal as the fuel source. These units haven't used natural gas for operational purposes since 2009.

So while coal has the advantage that it can be stored in large quantities on-site, it isn’t totally resilient to storms because it can become useless if it gets too wet.

This is just one of many facts overlooked by Perry’s arbitrary NOPR. Another is just how impractical it is to store 90 days of fuel on site for all forms of generation other than nuclear, which typically only refuels once per year. Even coal typically only stores 30 days of fuel at a time in coal piles that are already huge — tripling their storage capacity would cost money, increase risks of spontaneous combustion, and lead to more particulate emissions from coal dust.

University of Texas at Austin research scientist Joshua Rhodes did the math and calculated 90 days of fuel is equivalent to a 12-acre pile for a coal plant or 6.3 massive liquefied natural gas ships for a combined-cycle natural gas plant. (Click through to the tweet for some explanation of assumptions in the replies).

#90daysoffuel for 1250MW NGCC: ~6.3 LNG ships or ~400 acres of CNG tanks. Coal: ~12 acre pile. #energy #DOE_FERC_FPA

— Joshua Rhodes (@joshdr83) September 29, 2017

So for all intents and purposes it appears Perry’s NOPR will have little or no benefit to anyone with the exception of coal and nuclear power plant owners. What the NOPR does have is a significant price tag to cover out-of-market payments to prop up coal and nuclear power plants (not to mention any increased costs associated with managing new, giant coal piles).

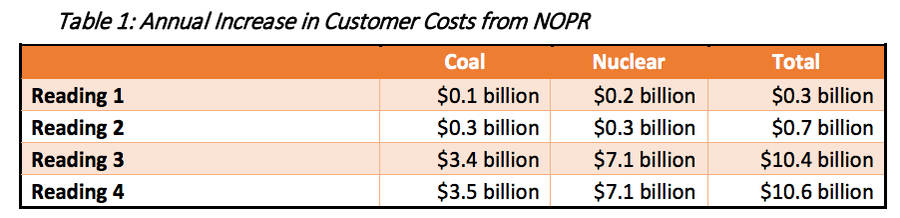

The energy and environmental policy firm Energy Innovation published an analysis of four different ways Perry’s NOPR might be legally interpreted, and what the associated cost to consumers would be. They found that the most conservative interpretation of the rule (“Reading 1”) would result in a cost of approximately $300 million annually, and that the most radical interpretation (“Reading 4”) would result in a cost of $10.6 billion annually.

It is not clear exactly how Energy Secretary Rick Perry’s proposed support for coal and nuclear plants will be interpreted. Energy Innovation evaluated four likely interpretations of the rule and found customer costs would increase by $0.3–$10.6 billion annually. Source: Energy Innovation

Better Ways to Improve Grid Reliability and Resiliency

The potentially huge annual price tag on Perry’s NOPR drives home just how arbitrary and unwarranted it is — not only because the rule provides essentially no resiliency benefits, but because there are a lot of better ways money could be spent to improve grid resiliency. Make no mistake, increasing the grid’s resiliency to major weather events is important, but Perry’s NOPR falls short. Here are just a few better ways we could spend money to improve the reliability and resiliency of the grid:

Bury more distribution lines. Newer distribution lines are already buried, money could go toward burying older ones.

Increase redundancy and interconnectedness in the transmission grid. While the transmission grid already has redundancy built in, increasing redundancy would make it more resilient and robust.

Minimize interdependent failure points between the natural gas and electric grids. Many natural gas pipelines are powered by electric compressors, risking a cascading problem after a power outage. Natural gas home heating demand combined with high electric demand during cold snaps can push natural gas pipelines to their limit. Investments in gas-powered compressors and pipelines can reduce these risks.

Bury critical transmission lines. This would be very expensive but could actually help prevent major disasters caused by severe transmission damage (like the one currently happening in Puerto Rico).

Invest in microgrids for critical infrastructure. Microgrids powered by solar, storage, and/or fossil fuels can isolate critical infrastructure after an outage. (Natural gas microgrids kept 18 H.E.B. grocery stores open in Texas after Hurricane Harvey).

Incentivize renewable energy to provide grid support. Wind and solar typically produce at full blast without providing grid services. They have the potential to provide a lot more grid support. (Solar example). (Wind example).

Expand the role of demand response. Incentivizing more loads to curtail their demand during a grid emergency increases the amount of resources that can respond to supply disruptions. (Texas avoided a blackout in 2014 thanks to demand response)

Build more energy storage in strategic places. Installing storage at the right places in the grid system could provide a vital lifeline after an outage and help restore power more quickly through “black start” service.

All of the interventions above would do more to improve grid resilience than Perry’s FERC proposal. And none of them involve the federal government doing anything nearly as radical as exempting certain forms of generation from market competition.

It’s hard to find any real justification for Perry’s NOPR besides a thinly-veiled attempt to prop up coal and nuclear plants. If you care about nuclear for its climate benefits, acknowledge climate change and put a price on carbon. If you care about the plight of coal communities, do more to support them than handout empty promises. If you care about grid resilience, spend money on things that will actually improve grid resilience. Don’t propose radical new regulations under false pretenses. There's already more than enough misinformation going around these days.