This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

Last month, J.P. Morgan Asset Management released its annual paper on the topic of energy. This year’s paper focuses on the costs associated with deep de-carbonization of electricity grids through the transition to renewable energy. In particular, the paper analyzes Germany’s so-called Energiewende, or energy transition, and the State of California’s transition to solar and other renewables, which the authors aptly dub Caliwende.

The report found that producing 80 percent of annual electricity supplies from renewable sources would significantly reduce carbon dioxide emissions—by about 55–70 percent—but increase the price consumers pay for electricity by about 20–90 percent, depending on the cost and mix of different zero-carbon resources.

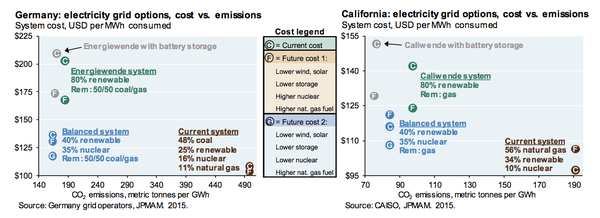

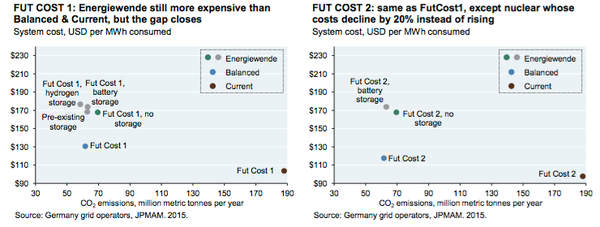

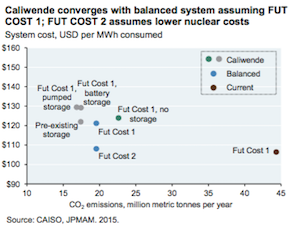

This figure illustrates the cost of electricity versus its carbon intensity in Germany and California under four different scenarios: the current system, an Energiewende/Caliwende heavy-renewables system, a heavy-renewables system with battery storage, and a “balanced” system that includes nuclear energy. For each scenario, the current cost (C) and future cost scenarios (F, G) are shown. (Source: J.P. Morgan Asset Management)

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

Where the report really triumphs is in its careful balance of technical rigor with accessible language and well-reasoned assumptions. In the words of the paper’s lead author and J.P. Morgan Asset Management Chief Investment Officer Michael Cembalest:

This paper gets into the weeds of hourly generation and intermittency. I found that it’s difficult to have a well-informed understanding of renewable systems without doing so. My goal: to give you a layman’s perspective of high-renewable systems while still adhering to the physical and engineering realities of electricity generation, stripped of the hyperbole which often accompanies the subject.

In my opinion, Mr. Cembalest and his colleagues have prevailed at their admirable goal. What follows is a summary of the paper’s key findings.

Renewables Produce Cheap Energy, but the Cost of Compensating for Their Intermittency Is Significant in Heavy-Renewable Grids

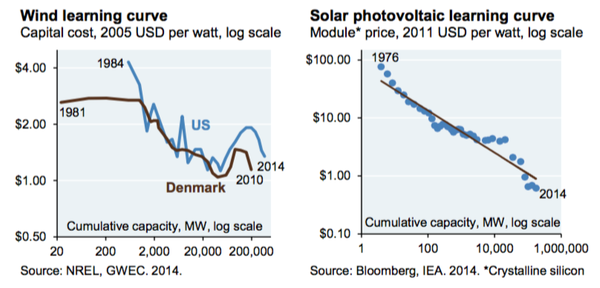

The upfront capital cost of renewable energy technologies like wind and solar has fallen significantly in recent years, driven mostly by continued growth in the cumulative capacity installed globally.

The cost of wind and solar power generating capacity on a dollar-per-Watt basis has fallen with increasing deployments. The wind learning curve exhibits a bump corresponding to rising raw materials costs in 2004. (Source: J.P. Morgan Asset Management)

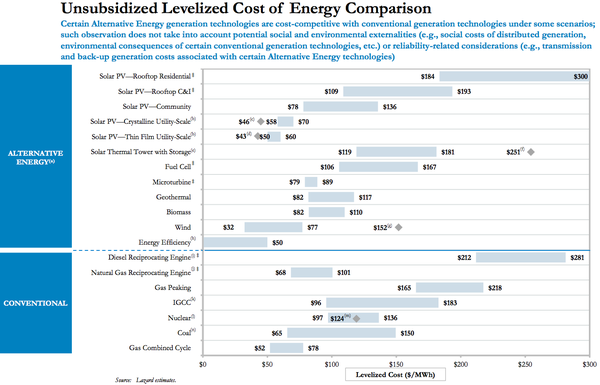

The steadily decreasing capital cost of wind turbines and solar panels has caused their “levelized cost of energy”—an apples-to-apples way of comparing electricity generating technologies—to fall below the cost of conventional forms of electricity generation like natural gas and coal, as illustrated in the figure below.

(Source: Lazard)

J.P. Morgan’s analysis confirms the findings of many in the academic community that levelized cost of energy becomes less and less meaningful for renewable energy technologies as they take on a larger role in the electricity mix. While the cost of energy generated by a solar panel or wind turbine might be competitive with the cost of energy generated from a gas or coal plant, the cost of energy from a grid dominated by renewable energy is almost certainly higher than the cost of energy from a grid powered by conventional sources—about 20–90 percent higher according to J.P. Morgan.

Heavy-Renewable Grids Would Require the Same Amount of Thermal Power Plants—but They Would Be Used a Lot Less Often

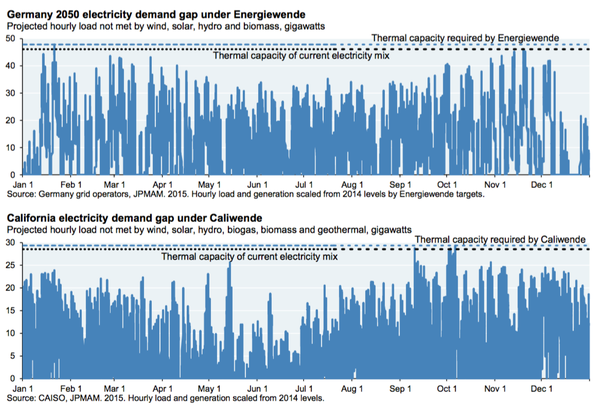

A primary driver for the higher cost of heavy-renewable grids versus conventional grids is the fact that backup power plants are required to meet demand during periods when renewable energy is not available.

J.P. Morgan found that energy generated from renewables reduces the amount of gas or coal that is burned in power plants by about 50 percent, but approximately the same number of power plants are required to ensure adequate electricity supplies 24 hours a day and 365 days a year.

To illustrate how much conventional thermal generating capacity would be required in a heavy-renewables scenario, J.P. Morgan graphed the portion of electric load not met by renewable energy during each hour of the year in Germany and California. About the same amount of power plants as today are required to meet demand year-round. (Source: J.P. Morgan Asset Management)

Energy Storage Can Reduce Overall Emissions and the Amount of Backup Power Plants Required, but It Increases Overall Costs

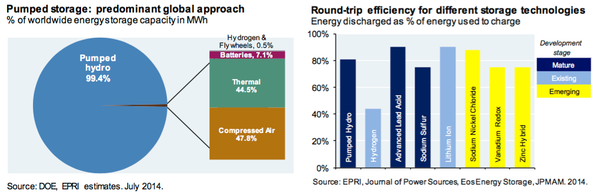

One technology that can mitigate the amount of backup thermal generation required by a heavy-renewable electric grid is energy storage. J.P. Morgan analyzed three of the most common energy storage technologies: pumped-hydro energy storage, battery energy storage, and hydrogen energy storage.

(Source: J.P. Morgan Asset Management)

The key advantage of energy storage in a heavy-renewable grid is its ability to store renewable energy that otherwise would have been wasted at times when renewable energy supplies exceed electric demand. By storing surplus renewable energy during these periods, energy storage can offset the need for backup generation from conventional coal or gas power plants, and reduce emissions. However, because energy storage capital and operating costs are higher than the benefits from avoided coal or gas consumption, adding energy storage increased the overall cost in all of the scenarios J.P. Morgan considered.

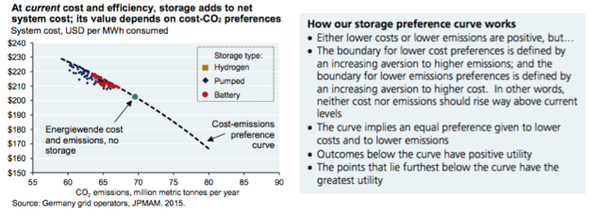

(Source: J.P. Morgan Asset Management)

To illustrate the tradeoff between the emissions benefit of energy storage and its added cost, J.P. Morgan created a subjective cost-emissions preference curve. Depending on how you feel about the tradeoff between cost and carbon dioxide emissions, you might prefer a grid with more energy storage. However, a heavy-renewable grid with no energy storage has less direct costs than a heavy-renewable grid with energy storage. This result aligns with recent findings by the academic community.

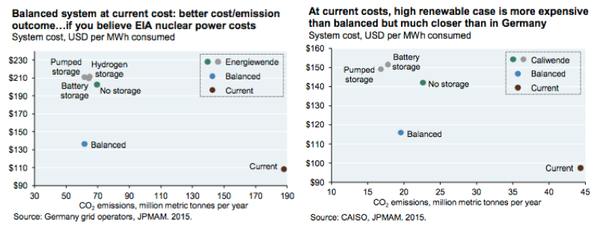

Nuclear Energy Can Reduce the Cost of De-Carbonization, but Its Cost Is Less Certain Than the Cost of Renewables

Due to exogenous concerns about safety, nuclear waste, and other factors, both Germany and California exclude nuclear energy from their plans for deep de-carbonization. However, experience has shown that nuclear can be a reliable source of (relatively) low-cost, low-carbon electric energy. Thus, J.P. Morgan analyzed the cost-emissions tradeoffs of “balanced” systems, in which nuclear is used to meet 35 percent of annual electric demand. They found that a balanced system would reduce emissions at a significantly lower cost than an Energiewende or Caliwende heavy-renewables system.

(Source: J.P. Morgan Asset Management)

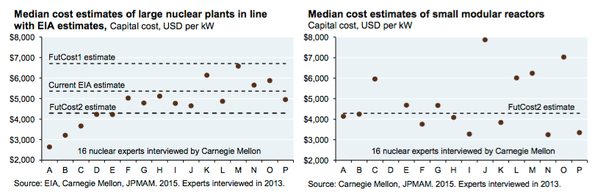

However, the results for the “balanced” system come with one big caveat: the cost of nuclear energy might be higher than the U.S. Energy Information Administration (EIA) predicts. In the United States, the real cost of electricity produced from nuclear plants has increased by 19 percent annually since the 1970s.

(Source: J.P. Morgan Asset Management)

J.P. Morgan used results from a study by Carnegie Mellon to establish a range for the expected future cost of nuclear energy. Their “FutCost1” scenario represents a future where nuclear capital, operation, and maintenance costs are 25 percent higher than those estimated by EIA. Conversely, their “FutCost2” scenario represents a future where nuclear costs are 20 percent lower, and in line with the current cost of nuclear power in South Korea. In both future scenarios considered, it is assumed that wind, solar, and storage costs decline and natural gas costs increase according to accepted trends.

(Source: J.P. Morgan Asset Management)

In both of these future scenarios, the balanced (nuclear plus renewables) system still provides a better cost-emissions tradeoff than a heavy-renewables system. However, the cost difference shrinks in Germany and nearly disappears in California for the case of escalating nuclear costs. In other words, societal preference for renewables might eclipse the cost advantages of nuclear if its real costs continue to increase.

We Can Reduce Carbon Emissions, If We Want To

My main takeaway from J.P. Morgan’s analysis is that we can transition to renewable energy or a mix of nuclear and renewable energy to significantly reduce carbon dioxide emissions—as long as we are willing to pay 20–90 percent more for electric energy. In these terms, the sacrifices required to mitigate climate change are more certain and tangible. Personally, I would be willing to pay the premium required to set the electricity system on a sustainable course. Would you?

Note: The full report ABrave New World: Deep De-Carbonization of Electricity Grids can be accessed for free at this link.