This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

It’s no secret that one of the Trump administration’s key priorities is taking a more offensive stance in the U.S.-Mexico relationship. By imposing import tariffs or similar trade adjustments, the new administration hopes it can prevent U.S. companies from shipping jobs to Mexico, and help raise funds to pay for the proposed $21.6 billion border wall.

A more aggressive U.S.-Mexican trade policy carries with it a number of risks not fully acknowledged by the new administration — and deviates from decades of conservative orthodoxy in favor of free trade. One particular risk is a slowdown in U.S.-Mexico natural gas exports, which have grown significantly in the wake of the U.S. shale gas revolution and increasing use of natural gas power generation in Mexico.

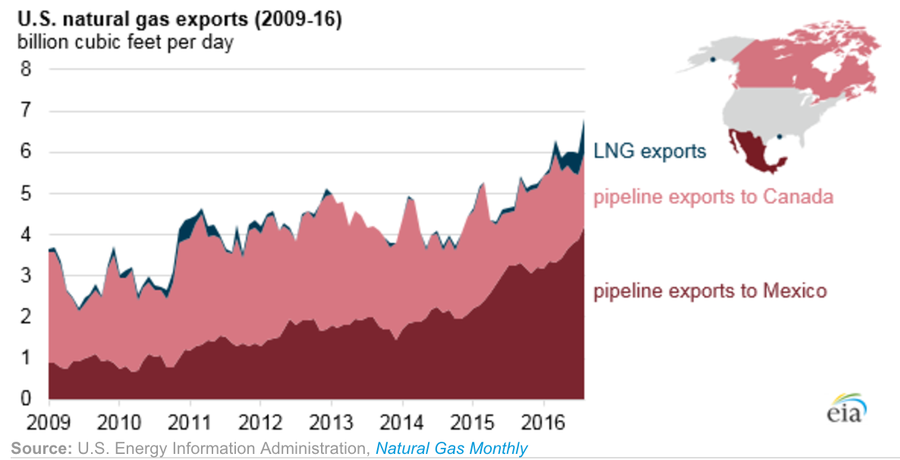

While there has been a lot of talk about the beginning of U.S. liquefied natural gas (LNG) exports, which have the potential to loosen Vladmir Putin’s grip on the European gas supply, the United States currently exports significantly more gas to Mexico than it does to the rest of the world. Simply put, it is much easier to move gas from Texas wells to Mexican customers via pipeline than it is to move gas from the United States to Europe — or from Texas to many parts of the United States for that matter.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

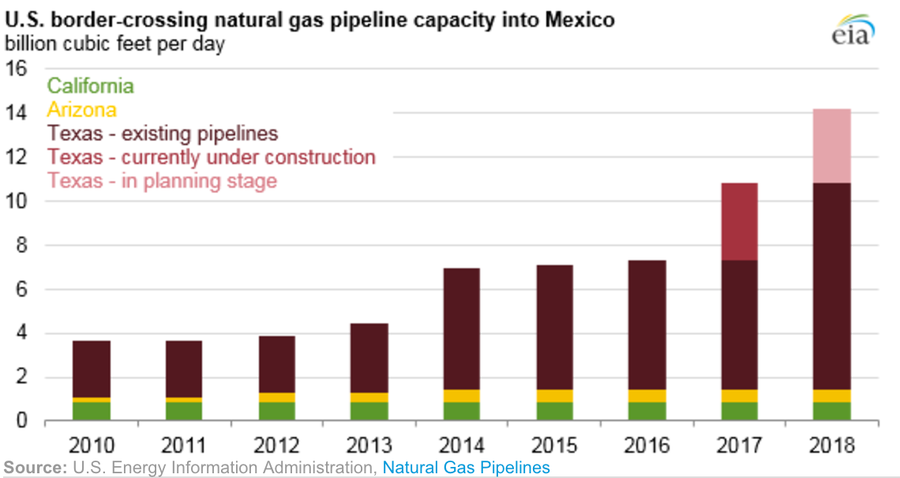

Since the beginning of the shale boom in 2009, the growing quantity of cheap natural gas from U.S. drillers has caused gas exports to Mexico to more than quadruple. And exports could nearly double over the coming years as U.S. export pipeline capacity increases from 7.3 billion cubic feet per day to over 14 billion cubic feet per day in 2018.

In addition to the U.S. shale boom and resulting natural gas glut, the expansion of export pipelines is also driven by Mexico’s landmark shift toward electricity sector competition. As part of the reform efforts, Mexico has established an independent grid operator that allows independent investors to build power plants and sell electricity to consumers. That means Mexico will see cheap and efficient combined cycle natural gas power plants replace many of its dirtier, expensive oil-fired power plants that were maintained by the monopoly utility company. And U.S. gas exports are expected to play a big role in powering all those new power plants.

In short, Mexico represents a one-of-a-kind market for U.S. gas producers. It’s geographically close to one of the largest sources of U.S. gas (Texas), and it’s undergoing fundamental energy sector reforms that will significantly increase its demand for gas in the future. That means the potential for big economic gains on both sides of the border — that is, if the protectionist posturing of the Trump administration does not disrupt the burgeoning U.S.-Mexico energy trade.

Gas wells, pipelines, and power plants are all capital-intensive investments that rely on steady and predictable policy environments to succeed. To date, the Trump administration has not clearly articulated the policies it will take with regard to U.S.-Mexico trade, leaving investors speculating and Mexican officials unsure how to respond.

Breaking down the U.S.-Mexico relationship might sound like “America First,” but in reality it could deprive U.S. natural gas producers a once in a lifetime market opportunity, and slow down the transition to cleaner, cheaper natural gas power plants in Mexico. That’s not good for the U.S. gas industry, and it’s not good for the environment we share.