This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

A social impact startup came to Common Cents Lab, our behavioral research laboratory, with a problem. They were struggling to get people to complete their multi-step online job application process. Our idea? We suggested they add a deadline to the application. This, we hypothesized, could increase completion rates.

The founder was appalled. By giving customers a deadline, the company would have to deny service to people who missed that deadline. Denying service, the founder argued, was not a part of their company values.

To understand if the company would actually be denying service by adding a deadline, we need to understand why a potential customer would start an application but wait until later to complete it.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

It’s possible that the applicant might start the application and realize that they want to take time to diligently fill it out while carefully considering each step. Maybe they even want to have other people look at it and review it before they formally submit it. On the other hand, it’s also possible that the person might start and stop believing they will have more free time in the future. This is called time discounting. The perceived cost associated with our effort diminishes when the task gets farther in the future.

To understand which explanation is most accurate, we partnered with another social impact company, the Kiva U.S. team at Kiva.org.

Kiva U.S. crowdfunds interest-free loans to small businesses in the United States. To qualify, applicants must fill out eight pages of information. This includes detailed information about the business’s revenue and accounting, a picture of the business and social media information about the business. This is obviously a multi-step setup process, and it results in many small businesses starting the application but failing to complete it—the conversion rate is roughly 20 percent.

If the process requires a small business owner to invest significant amounts of time, then adding a deadline should decrease the number of applicants. People just won’t have time to fill out the forms and they would miss the cut off. However, if people instead forget to complete it or are procrastinating, the deadline may be a helpful way to clarify their thoughts, create an action plan and complete the application.

So what happened?

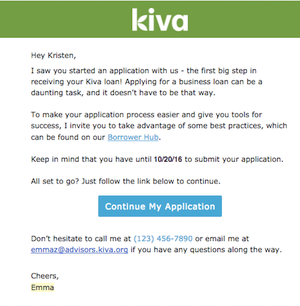

We created two email responses. The first one had no deadline.

.png?w=300)

Credit: Kristen Berman

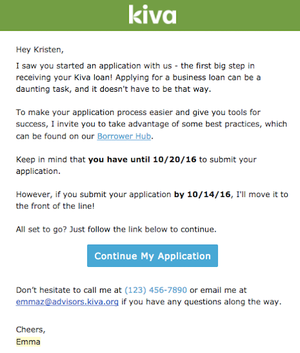

Then we added a deadline—and 24 percent more people completed the application.

Credit: Kristen Berman

This meant that at least 12 percent more small business owners received a zero percent interest rate loan for their company. The results suggest that these new Kiva U.S. customers didn’t require significant amounts of time to complete the application; they just hadn’t prioritized it.

Is there a way to further increase the power of a deadline?

For their next test, the Kiva U.S. team incentivized even earlier completion by pairing a new, earlier deadline with a benefit. By submitting the Kiva loan application a week before the final deadline, the applicant would move to the front of the line. Instead of punishing lateness, this intervention rewards the early bird.

Credit: Kristen Berman

The result: completed applications increased by an additional 26 percent over having a single deadline. The majority of tasks we procrastinate on are usually high in immediate costs but low in immediate benefits, thus making them unattractive in the short run. This additional benefit may have helped make the task of applying become more attractive and thus less likely to be in danger of procrastination.

It’s also possible that shorter deadlines in and of themselves could be more helpful. To understand this let’s look at something very different than an online loan. Researchers Suzanne Shu and Ayelet Gneezy tracked redemptions of bakery gift certificates. They found less than 10 percent of people redeemed a gift certificate that was good for two months. However, more than 30 percent of people redeemed a gift certificate that was good for only two weeks. Gneezy and Shu then asked people who did not redeem the certificate why they didn’t. They found the most agreement with statements like, "I kept thinking I could do it later." The group with the shorter deadline window appeared to be most able to overcome this procrastination barrier.

Shu and Gneezy’s research supports existing academic insights on time management. In 2002, psychologists Dan Ariely and Klaus Wertenbroch ran an experiment that put deadlines to the test. Literally. Students were given no deadlines, created their own deadlines or had to adhere to deadlines set by the professor. The students without deadlines performed the worst at the end of the semester and students with externally imposed deadlines performed the best.

The academic research, along with the Kiva U.S. team’s research, suggests that we may often put off doing something, not because we need more time or have a strong preference to delay, but because we haven’t clearly put it on our calendar. Without a deadline, plans may not materialize into action even if there is intention.

That founder was right to be worried about at the idea of denying service to their customers. But to keep in line with their company values, instead of removing a deadline, we would need to add one.

How could we apply deadlines to other domains? Three ideas:

Taxes: According to data from the Internal Revenue Service, nearly 13 percent of taxpayers put off filing until the last week possible, more than double the 5 percent average through the month of March. Could the government incentivize filing early and help the 12 million people who file an extension or suffer late fees?

Finances: According to our Common Cents survey, most Americans would like to be more financially secure. Why aren’t we? Maybe it’s because we don’t know what to do in order to attain financially security. But according to our survey, this isn’t the case. On average people can list four tactics they personally could do to improve their own financial well-being (the tactics vary widely from person to person). If ignorance isn’t the problem, it’s possible we’re not taking action because these four tactics have yet to make it onto our daily or weekly action plan. Given the research with Kiva U.S., we may just need another person (or app) to create a deadline for us to take the actions we already know we should be taking.

Personal Productivity: When your co-workers aren’t putting a deadline on you, work tasks might victim to procrastination. This can be a daily struggle between the items on your to-do list with deadlines and the ones without. The good news is that creatively imposing deadlines on yourself may help. For example, the day I started writing this article, I scheduled a public presentation about the results for three weeks later. As this public presentation got closer, my anxiety increased, but so did the number of words on the page. The weekend before the presentation I completed this article. Who knows if you would be reading this without that deadline?

Special thanks to Jonny Price, Adam Kirk and Kiva U.S. for running the experiment and to MetLife Foundation for supporting Common Cents. MetLife Foundation believes that everyone should have access to the right financial tools and services to build a better tomorrow.