This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

There is a $2,850 check with your name on it just waiting for you. All you need to do is file a few forms and it’s yours. You have three months to claim it. How quickly would you act? If you are like the authors, your answer is right away!

Sadly, this is not what people do. Instead, they wait.

Last year, 73 percent of tax filers received a tax refund of $2,860, on average. That is roughly one month’s net pay for the median income household in the United States.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

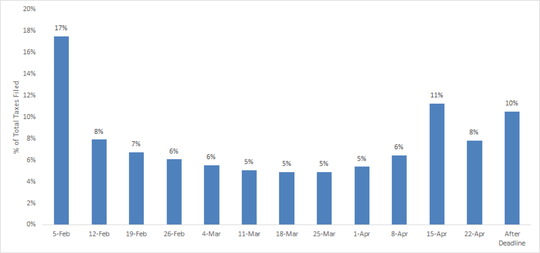

According to the IRS, 25 percent of tax filers submitted their taxes between April 1st and April 22nd. In addition, 10 percent of tax filers submitted their taxes after the deadline.

Filing statistics for tax year 2015. Credit: Internal Revenue Service

So why are people waiting to file?

One explanation could be that people who wait until the last minute to file are the ones who won’t receive a refund. If this is the case, these people are being rational and optimizing the timing of their financial outlay.

However, this does not seem to be the case for everyone. Roughly 32 percent of all tax refunds are given out after April 1. That’s 35 million people who are waiting to claim their check!

Some may be tempted to say that people who wait until the last minute to file their taxes just don’t like free money. This is clearly absurd. Yet, this line of thinking is used by many business leaders and product managers. We assume that product uptake is a direct function of people’s preferences or interest.

Let’s take a look at an example of this.

Imagine you’re an employer and are offering a 3 percent 401(k) matching program. This will allow your employees to get thousands of dollars toward their retirement.

After launching the program you see a dismal uptake rate of 40 percent. As an employer you must decide if you should continue the program. You might decide to discontinue it, since the majority of employees have not claimed their cash. People must not want to save. Maybe they don’t like savings, or maybe they don’t have enough money to save for retirement.

John Beshears, James Choi, David Laibson, and Brigitte Madrian challenged this line of thinking and designed an

easier enrollment option for employer 401k matching programs. This intervention increased enrollment rates by 10-20 percentage points.

What’s the lesson? Our inactions reflect both our preferences and our decision making environment. It’s not that people hate savings. It’s that the old enrollment flow was cumbersome. People have busy and complicated lives. Anything that takes considerable time and effort often times gets pushed off to the imaginary time-rich tomorrow.

Tax filing suffers the same fate.

On average the IRS expects non-business filers to have an average burden of about nine hours and payment of $120 to file. While the benefit of free money may loom large, what likely looms larger is the complexity and time costs of filing. When things are complex, we procrastinate, even when the payoff is exceptionally high.

Good news. There is a silver bullet, called a “deadline.”

We partnered with another social impact company, the Kiva U.S. team at Kiva.org to fully understand the power of deadlines. Kiva U.S. crowdfunds interest-free loans to small businesses in the United States. To qualify, applicants must fill out eight pages of information. This includes detailed information about the business’s revenue and accounting, a picture of the business and social media information about the business. While this is long process, the payoff (a zero-interest loan for your business) is massive. When we added a simple deadline to finish the loan application, 24 percent more people completed it.

The tax day deadline is typically associated with stress—so much so that car accidents are shown to rise on April 15th. However, it’s possible we may want to be grateful there is a deadline that puts us out of our misery and helps us claim our check.

Food for thought: Let’s make it March 15 instead of April 15

We can strengthen the power of deadlines by decreasing the time of the deadline. For example, Suzanne Shu and Ayelet Gneezy found that longer deadlines, compared to shorter deadlines, encourage people to procrastinate, even on things they like to do, like claiming free spa certificates!

Most of us can file right after we get our W-2s and 1099 tax forms in January or February. Maybe we can eliminate late filers by making the deadline earlier rather than extending it.

Special thanks to MetLife Foundation for supporting Common Cents. MetLife Foundation believes that everyone should have access to the right financial tools and services to build a better tomorrow.