This article was published in Scientific American’s former blog network and reflects the views of the author, not necessarily those of Scientific American

The future of transportation was a hot topic at last week’s Future of Energy Summit in London hosted by Bloomberg New Energy Finance (BNEF).

In particular, discussions were built around the question of what transportation will look like as the sector tries to balance 1) meeting demand and 2) compliance with air pollution standards.

Two events at the Summit – a discussion with Aston Martin CEO Andy Palmer and a panel on transport, cities, and air pollution – highlighted this tension. Both were moderated by BNEF’s Head of Advanced Transport, Colin McKerracher. I had the chance to sit down with McKerracher to discuss the topic further. Below is an condensed and edited version of that discussion.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

Photo of Colin McKerracher in an "Executive Interview" with Aston Martin CEO, Andy Palmer Credit: Melissa C. Lott (2015)

Melissa C. Lott: In your interview with Aston Martin CEO Andy Palmer, he said that the future of transportation is electric. Do you agree? Is that was your analysis is showing?

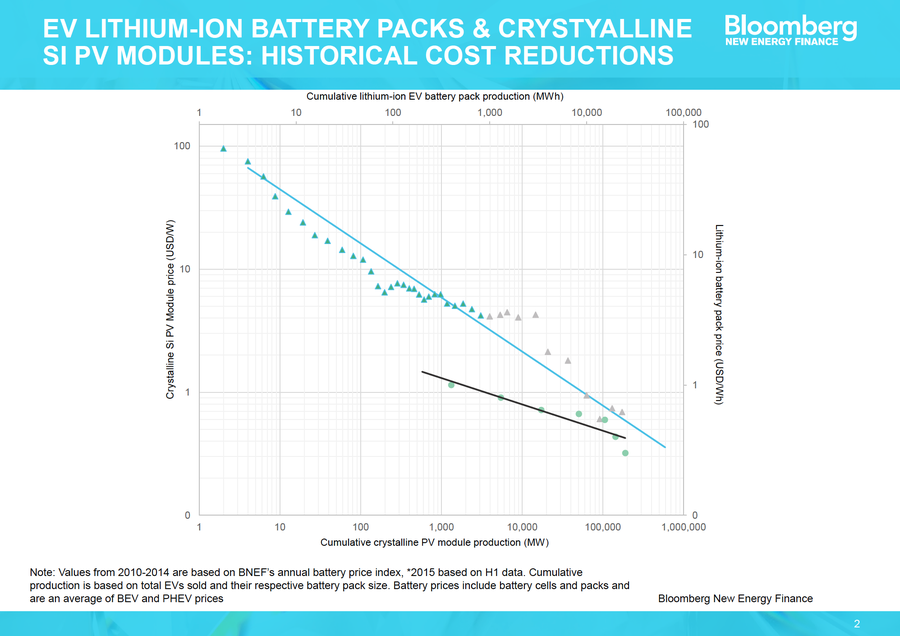

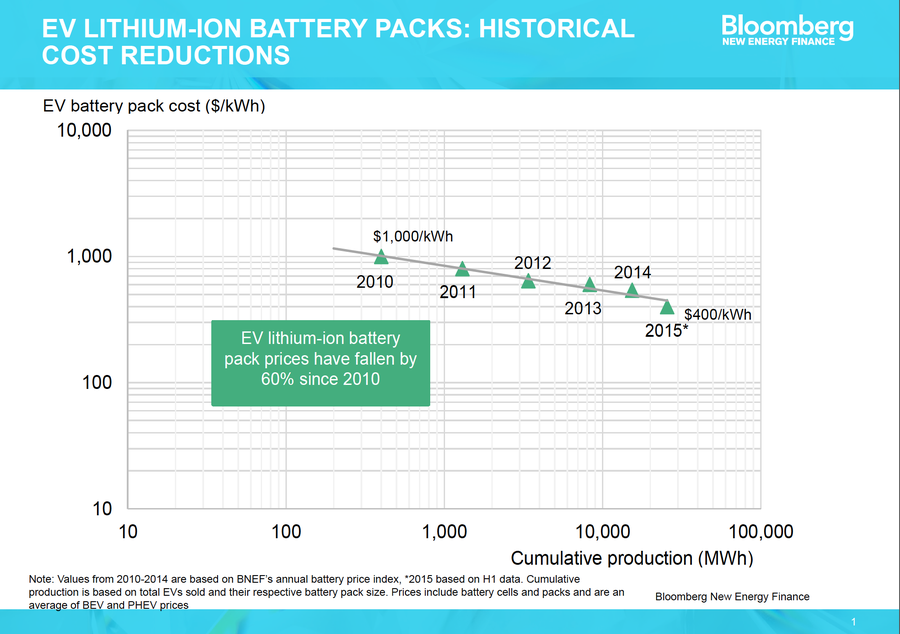

Colin McKerracher: I agree, the future is electric, but the timeframe is still uncertain. In many ways, transport looks like the power industry when BNEF first started covering renewables back in 2004: you have growing policy support, shifts in public perception and most importantly, rapidly changing technology costs. Solar and other renewables went from marginal to large scale disruption in a short time off the back of steady technology cost improvements.

We are seeing the beginnings of the same effect with the electrification of transport as battery costs fall. EV lithium-ion battery costs are down more than 60% since 2010 and we expect this to continue. This will be very disruptive and will happen sooner than many expect.

Credit: Bloomberg New Energy Finance (used with permission)

Credit: Bloomberg New Energy Finance (used with permission)

There are a few other things that indicate that transportation is moving toward EVs – first, the power sector is getting cleaner every year and so an electric vehicle is cleaner every year. Also, we see policies – like fuel economy standards in the U.S. – that are set to get much more stringent and push automakers towards hybridization or full electrification. Our analysis indicates that it will be very difficult to meet these existing standards without much more electrification. So, I agree with the statement that the future is largely electric. Though, there will still be some applications like heavy trucks, that will use other things – but the passenger vehicle trajectory is clear.

My long term view is that all passenger vehicles will have batteries and plugs. The question is will they have gasoline tanks as back-ups too. This split between battery electrics and plug-in hybrids is still uncertain.

Lott: On this topic - do you think that range anxiety will continue to be as big of a challenge in the future?

McKerracher: I think that there will probably be a place for both plug-in electric vehicles with gasoline back-up and all electric models for awhile. But, the new car models that we are seeing come out in the ’17, ’18, and ’19 models from GM, Tesla, and others have 200+ mile ranges. This changes the equation quite a lot.

My view is that we won’t immediately converge to all-electrics. But, we will have a growing market. We forecast that 30% of new passenger vehicles will be plug-in hybrids or full battery electrics by 2030 in the United States. This is probably a bit conservative as it doesn’t consider potential policies changes. If we were to get some fairly draconian air quality policies, this number could go up significantly. Norway is an example that comes to mind as a country with generous support where EVs are already hitting 15-20% of new vehicle sales.

I think that we could get much faster adoption of electric vehicles because of these urban air quality problems and global pollutant concerns. We are running the transport, cities, and air quality panel that we held today in London in our subsequent events in Shanghai and New York – I am interested to see how those discussions will compare to each other.

Lott: Is range anxiety really what keeps people from buying electric vehicles today? Or is it total cost?

McKerracher: It’s upfront cost. When we look at buying cars, we don’t really look at total cost of ownership. At least not yet. The psychology behind this is that people don’t think about spreadsheets and discounting costs over time.

Right now, the upfront cost is high, but the next round of mass market EVs is set to make this much more accessible.

Passenger vehicles are not the only area we’re seeing activity. We are seeing the cost of electric buses coming down and the orders for these companies starting to tick up. Battery prices are coming down. And so, here, cities are making choices based on total cost of ownership. Then the question becomes financing. But, we have models – for example, in the energy efficiency sector – that can help us to work on this problem. Once we get to this point, there are innovative people who can make this type of investment work.

Lott: What about charging infrastructure? Will connected cars help us to get past range anxiety?

McKerracher: The trends around connectivity, car sharing and electrification reinforce each other. For example, with the DriveNow UK car-sharing program, part of the reason that they are able to use electric vehicles in a sort of free-floating car-sharing scheme is because of connectivity. You’re able to just go and collect a car. The system filters out the cars that don’t have enough battery power. The system then rewards you for parking a car back in a charging doc, etc. Shared vehicles have higher utilization rates, so the economics of switching to electrics are more attractive. All these things reduce the friction that might prevent the use of electric vehicles and so this connectivity enables the business model.

These systems can also provide you with a lot of information on what’s going on in your system – where and how your vehicles are being used and where your charging points need to be. The same thing happens with bike-sharing programs, where big data show where there are empty bays and where the system is overloaded. This means you can make a plan for moving bikes around to meet demand. This data helps reduce the costs of these types of programs.

Lott: What about lifestyle? What is the role of psychology and changing generations of people on how our transport systems will develop?

McKerracher: There are many psychological things to consider – in the case of millenials and changing aspirations around car ownership, these things are real. I think that this plays into in the idea of mobility as a service instead of an asset. I wouldn’t want to paint this into too extreme of a light – it only affects a certain part of the population. But, at the margins – like in cities – it’s significant.

Lott: Are EVs a chance for utilities to offset concerns about flattening and declining electricity demand?

McKerracher: We work with a lot of utilities and many of them are looking at new downstream services – they are looking at charging infrastructure to see what the opportunity is there as well. I think that in the much longer term, there’s the potential to partially offset some declines in electricity demand. Only partially – our analysis shows that it doesn’t fully offset declines in electricity demand in advanced economies, but it is responsible for some growth.

In the United States for example, we see EVs contributing an additional 2% electricity demand growth by 2030. It’s not a lot, but it’s most of the growth and will prevent decline in the U.S. market. It’s also new shift-able loads, which can contribute to better asset utilization for utilities. EVs can be charged largely at night and decrease peaking of electricity demand.